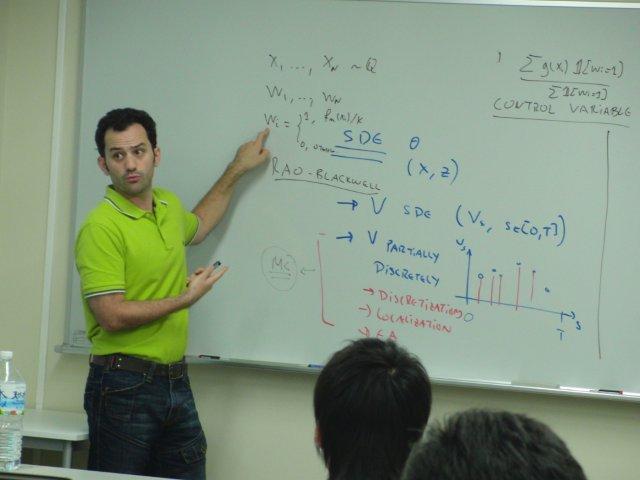

Part Ia: brief introduction to SDEs

(Ito lemma, linear SDEs, generator)

Part Ib: Statistical inference for SDEs

(observation schemes, probabilistic inference, approaches in the literature)

Part II: Statistical inference for the fully observed case

(quadratic variation, Girsanov's theorem for likelihood inference)

Part I and II would be covered in at most 2 hours.Part II is essential

for what follows

Part III: discrete-time dynamics of diffusions and discrete-time likelihood

(discretization schemes, local linearization, pseudo-likelihood, exact

simulation of diffusions)

Part III should be about 1.5 hour.

Part IV: Monte Carlo inference for discretely observed diffusions with

known diffusivity

(missing data and a formal data augmentation, data augmentation for diffusions,

simulation of diffusion bridges, MCMC for parameter estimation)

Part IV should be about 1.5 hour.

Part V: MCMC for general reducible diffusions

(Lamperti transformation and reducible diffusions, lack of convergence of basic MCMC algorithms, transformations of diffusion paths and efficient MCMC)

Part V should be about 1 hour.

Part VI: MCMC for irreducible partially observed multivariate diffusions

(Durham and Gallant approach, general diffusion bridges, path transformations,

unobserved components)

Part VI should be about an 1 hour.

Copyright c 2010 JST/CREST コハツ・チーム

| □2010.6.23 - 7.7,16:20-18:30開催 |

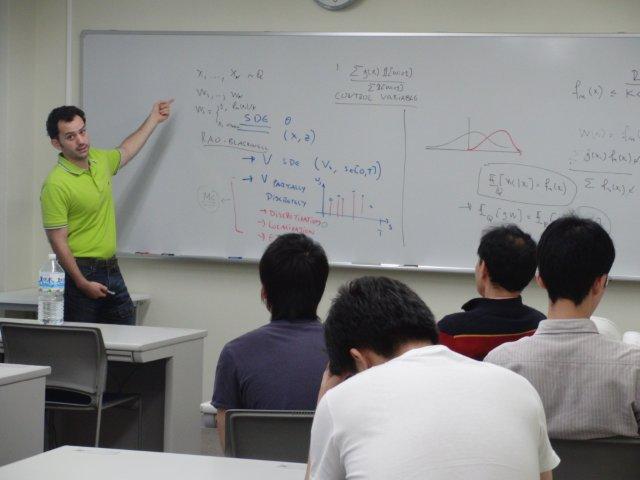

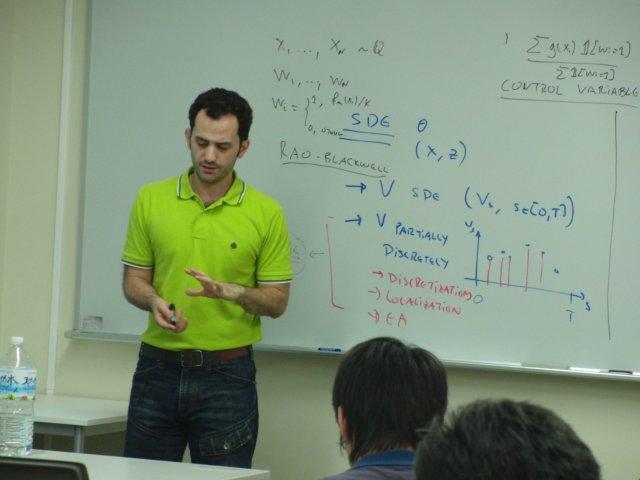

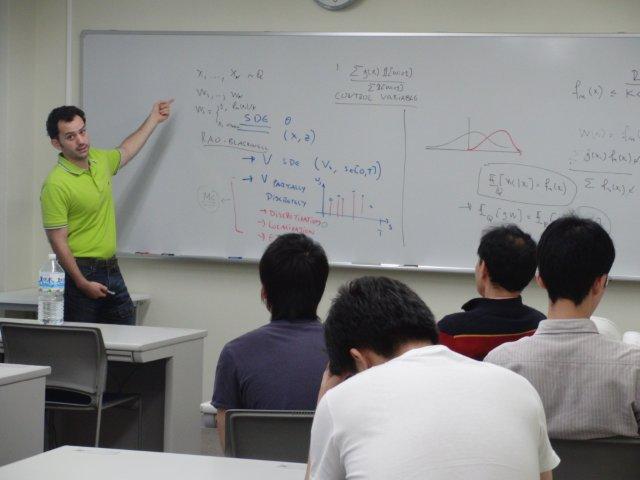

Monte Carlo Likelihood-based Inference for Diffusions (モンテ・カルロによる尤度に基づいた拡散過程の推測) Monte Carlo Likelihood-based Inference for Diffusions (モンテ・カルロによる尤度に基づいた拡散過程の推測) |

講演者:Prof. Dr. Omiros PAPASPILIOPOULOS, Asst. Professor in the Dept. of

Economics and Business and Ramon y Cajal Research Fellow at the Universitat Pompeu Fabra

|